41 candidates to replace Gavin Newsom already handed over their tax returns. Office of California Secretary of State Public Domain

After 41 candidates to replace Gov. Gavin Newsom in the Sept. 14 recall election submitted their income tax returns going back to 2016, a Superior Court judge ruled on Wednesday that they didn’t have to do so after all, CalMatters reported. Nonetheless, the tax returns remain online via the California Secretary of State’s website.

In 2019, Newsom signed a bill that required candidates for governor and for United States president to reveal five years worth of tax returns. Passed on a party line vote, the law was an attempt by Democrats to force then-President Donald Trump to release his tax returns, a step he long refused to take, breaking with a longstanding tradition for presidential candidates.

After just six months, and about a year prior to the 2020 presidential election, the state Supreme Court ruled in Trump’s favor when he challenged the law. The requirement for presidential candidates to hand over their tax returns came into conflict with California’s state constitution, the court decided. But though the court tossed out the requirement for presidential candidates, it made no ruling on the requirement for gubernatorial candidates.

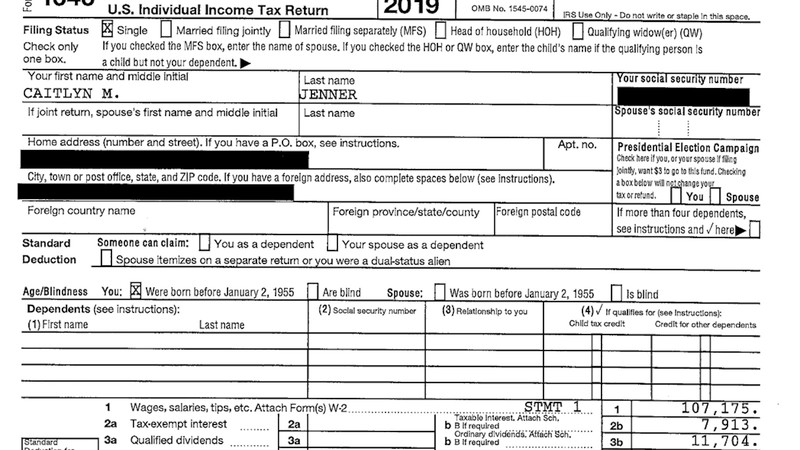

As a result, California law continues to require candidates for governor to submit their most recent five years of tax returns, which 41 did earlier this week—including such prominent hopefuls as reality TV star Caitlyn Jenner, and San Diego Mayor Kevin Faulconer—completing their requirements to appear on the Sept. 14 ballot.

One big name in the race to replace Newsom, however, seemed to challenge the tax return requirement. Nationally syndicated conservative talk radio personality Larry Elder submitted his returns, but Secretary of State Shirley Weber rejected them because they contained errors. Now, Sacramento County Superior Court Judge Laurie Earl has ruled that Elder may appear on the ballot anyway.

“We fought the shenanigans of Sacramento’s politicians and we won,” Elder said in a statement released after Earl’s ruling. “If elected governor, I will fight every single day for this state. This is just the beginning.”

Three other candidates—retired schoolteacher Rhonda Furin, U.S. Global Business Forum founder Kevin Kaul, and self-described “born-again Christian and a Conservative Republican” Joe Mwangi Symmon (who ran for governor in 2010 as a Democrat)—also declined to reveal their tax returns, but will now appear on the ballot.

In her ruling, Earl did not strike down the 2019 law, but instead decided that as written it applied only to primary elections. The recall election, she ruled, is a “special election,” not a primary. Therefore, candidates are exempt from disclosing their tax returns.

Even prior to Earl’s decision, Newsom himself was not required to reveal tax returns because as the sitting governor facing a recall bid, he is not considered a “candidate.” Earlier ths year, however, Newsom revealed his 2019 tax return, showing that in his first year as governor he and wife Jennifer Siebel Newsom took in about $1.7 million, according to a Sacramento Bee report.

Newsom had not yet filed his 2020 tax return at the time.

The returns now on file with the secretary of state show that the highest-paid candidate to replace Newsom is Traffik advertising CEO Anthony Trimino, a Republican who earned over $4.3 million in 2020, according to a Bee report.

Jenner had not yet filed 2020 taxes, but her 2019 return showed earnings of $558,774 in 2019, about 65 percent of it appearing to come from income related to her 2017 book, The Secrets of My Life.

Faulconer earned $358,119 in 2019, the latest year of returns he submitted, which was about twice what he earned the year before. Most of his income came from his wife, Katherine Stuart, who owns an event business that stages large parties in San Diego’s bustling Gaslight District, according to a San Francisco Chronicle report.

San Diego investor John Cox, Newsom’s Republican opponent in the 2018 general election, reported just $278,928 in 2019, paying only $1,099 in taxes after earning about $2.7 million over the three previous years.

Read the candidates’ tax returns as posted by the secretary of state’s office.

Short articles summarizing reporting by local news sources with linkbacks to the original content.